Table of Contents

Why Inflation Hurts the Middle Class the Most (Explained Simply)

Inflation is often described as “prices going up.” That description is true—but incomplete. What inflation really does is quieter and more personal: it slowly changes how much your money can do for you.

You may not feel it all at once. Life goes on. You still go to work, pay your bills, and manage your month. But over time, something shifts. The same income supports fewer choices. Small comforts get postponed. Plans feel tighter.

This experience is especially common for the middle class. Not because the middle class makes the worst decisions—but because of how inflation interacts with income, expenses, and expectations.

This article explains inflation in simple terms and shows, step by step, why the middle class tends to feel its impact the most—without politics, blame, or economic jargon.

Inflation, explained simply: money buying less

At its core, inflation means your money loses purchasing power over time.

If you could buy five items with a certain amount of money last year, and only four with the same amount this year, inflation has occurred.

It’s not about one product becoming expensive. It’s about many everyday things rising together:

- groceries

- rent

- fuel

- school fees

- healthcare

- utilities

When this happens across the board, your lifestyle costs more—even if nothing about your life has changed.

Think of it this way:

Your income is a container. Inflation slowly shrinks what that container can hold.

Why inflation happens (without technical language)

Inflation doesn’t come from one single cause. It usually emerges from a combination of everyday forces in the economy. Here are four common ones, explained simply.

1. Costs rise across the system

When fuel, transport, raw materials, or wages become more expensive, businesses adjust prices to survive. Those increases eventually reach consumers.

For example, higher fuel costs affect delivery trucks, which affects grocery prices, which affects your monthly food bill.

2. Demand grows faster than supply

If more people want something than what’s available—homes in a city, seats in a good school, certain food items—prices rise.

This is common in fast-growing cities and expanding economies.

3. Supply disruptions

Weather events, logistical issues, shortages, or global disruptions can reduce supply temporarily. When goods are scarce, prices often spike.

You’ve likely seen this with vegetables, fuel, or essential items at different times.

4. More money chasing the same goods

When overall spending power in an economy increases faster than production, prices tend to rise. This effect is gradual and often unnoticed until it accumulates.

The key point: inflation is usually a system effect, not a single decision or event.

Inflation doesn’t affect everyone equally

Even though prices rise for everyone, the experience of inflation is uneven. This depends on how people earn, spend, and save.

A helpful way to think about this is budget shape.

- Some people spend almost everything on basic survival.

- Some people have high flexibility and large buffers.

- The middle class sits in between—with obligations, plans, and limited margin for error.

That middle position is what makes inflation especially uncomfortable.

Who is “middle class” in practical terms?

Rather than income numbers, it helps to think in patterns.

A typical middle-class household often has:

- a steady salary or business income

- fixed monthly commitments (rent or EMI, utilities)

- long-term goals (education, home ownership, healthcare security)

- some savings, but not enough to absorb repeated shocks easily

Their lifestyle depends on predictability. Inflation disrupts that predictability.

Why inflation hurts the middle class the most

Let’s now look at the specific reasons—step by step—using everyday examples.

1. Essentials rise faster than income adjusts

Prices can change quickly. Salaries usually don’t.

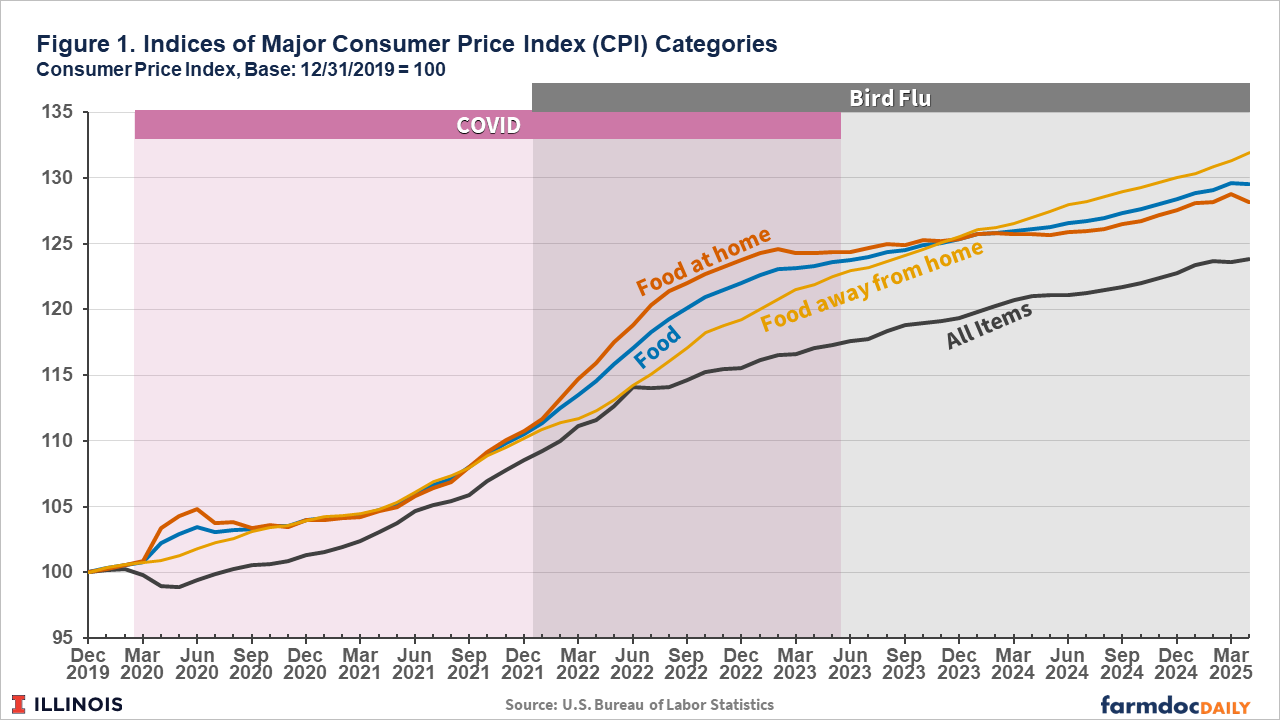

Groceries may rise several times in a year. Rent may increase annually. Fuel prices fluctuate. But most people see income adjustments once a year—or less.

Even when raises happen, they often lag behind real increases in living costs. This creates a silent gap: you earn more on paper, but feel poorer in practice.

2. Fixed commitments leave little room to adjust

Middle-class households typically have non-negotiable expenses:

- rent or home loan EMIs

- school or college fees

- insurance premiums

- basic utilities

Inflation increases day-to-day costs on top of these fixed payments. You can’t easily reduce an EMI, but you still have to manage higher food, transport, and service expenses.

This pressure builds month after month.

3. Savings may grow—but still fall behind

Many middle-class families save consistently. But inflation can quietly erode the value of those savings.

If your savings grow slowly while prices rise faster, your money increases in number but loses real-world strength.

In simple terms:

Your balance may look higher, but what it can buy becomes smaller.

This is one of inflation’s least visible effects—and one of the most damaging over time.

4. The middle class absorbs full impact without cushions

In many systems:

- Lower-income groups may receive targeted support for essentials.

- Higher-income groups often own assets or have buffers that adjust with inflation.

The middle class frequently falls in between:

- not eligible for support

- not insulated by large assets

As a result, price increases are absorbed directly—without relief on either side.

5. Inflation hits aspiration costs the hardest

Middle-class goals are often inflation-sensitive:

- quality education

- better housing

- reliable healthcare

These areas tend to rise faster than general inflation because demand remains strong regardless of price.

A family may manage food inflation with substitutions—but school fees, rent in good locations, or medical expenses leave little flexibility.

6. Lifestyle quietly downshifts

Inflation doesn’t always create visible hardship. Instead, it often leads to silent trade-offs:

- fewer outings

- delayed purchases

- switching to lower-quality options

- postponing upgrades

Nothing dramatic happens—but over time, quality of life subtly narrows.

This quiet adjustment is one reason inflation feels mentally exhausting rather than immediately alarming.

The three-sided squeeze model

All of this can be summarized in one simple framework.

Inflation squeezes the middle class from three directions at once:

- Costs rise (essentials and aspirations together)

- Income lags (adjusts slowly)

- Savings weaken (lose purchasing power)

When all three act together, even stable households feel pressure.

Practical, non-alarmist ways to respond

This is not about panic or drastic measures. It’s about awareness and small adjustments.

Some sensible habits include:

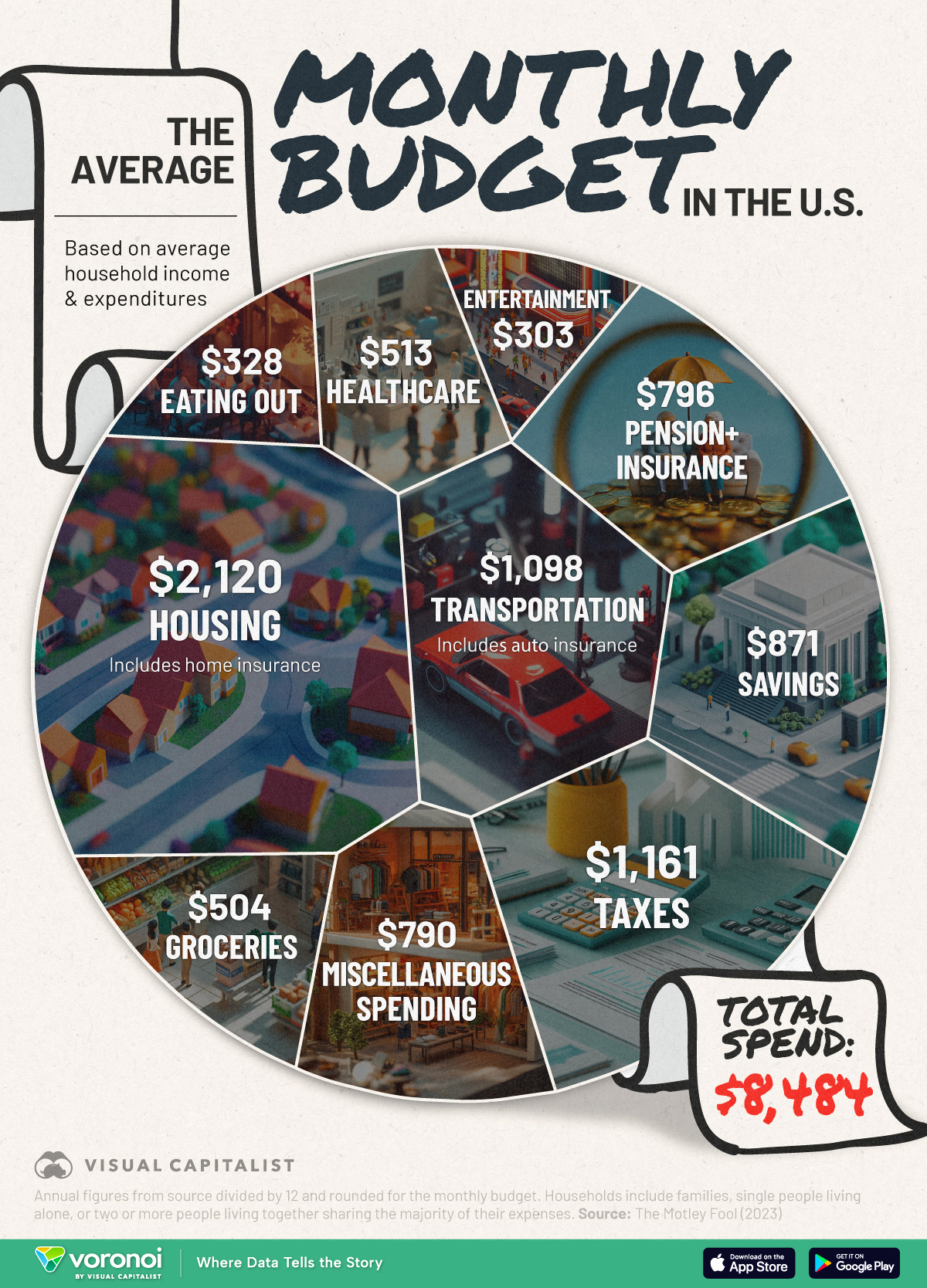

- tracking major cost drivers (housing, food, transport, education, healthcare)

- reviewing budgets periodically rather than assuming stability

- building modest buffers before lifestyle upgrades

- reducing exposure to high-interest obligations

- aligning income growth with skills and outcomes over time

These aren’t quick fixes—but they restore a sense of control.

A calm conclusion

Inflation is not a moral failure, a personal mistake, or a political argument. It’s a systemic force that reshapes everyday choices.

The middle class feels its impact most because its life is built on planning, stability, and gradual progress—exactly the things inflation quietly disrupts.

Once you understand the mechanisms, inflation becomes less frightening and more manageable. It stops being an invisible pressure and becomes something you can plan around.

Inflation is loud in prices—but quiet in how it reshapes daily life.

Read more articles on WiderDepths.